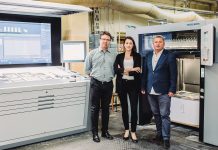

A conversation with Alina Roszczyńska – the owner of GROWTH LD in Krakow, and the insurance agent using coaching attitudes in financial counselling, nominated for the title of Charismatic Woman – on various practical forms of life and corporate insurance.

You are an active team member of leadership trainers, coaches and motivational speakers associated with the international Maxwell Leadership Certified Team (MLCT) organisation. When exactly your charismatic qualities manifested?

I was probably born with those qualities, however, I stayed unbloomed for quite a long time and needed the right time and place to develop. I used to be a diligent learner, determined to prove myself. As a good and obedient girl, I had very little self-confidence. Both my parent liked to have a final word in any discussion, so I grew up in a sort of a hiding place. It all lasted until I established my own life and got through various challenges. Then I started to stomp my foot and say: I am able to achieve and live by my own rules. I was once invited to attend a leadership training. Everybody but me spoke on their dreams, goals, opportunities, or leadership. As a very directive and hard-headed person, I felt it wasn’t for me and decided to leave. However, the seed germinated and grew at the right time.

So, what was your path until you flourished and how did you acquire your competences?

I graduated from the Medical Dietetic College and started working as a dietitian in a nursing home. I also managed the nutrition department at the Rheumatology Hospital. I took up my studies later when I already had a family and children. I finished business management at the University of Law and Administration in Warsaw and postgraduate studies in quality auditing. I felt the verve, started to move around in different environments and found out that education alone doesn’t do much. It’s important to believe in yourself. I went to the USA for two-week time and stayed there for four years. I worked with a friend who ran her own business. I found my second husband there and brought him to Poland (laughs). Later, I was in charge of marketing and organisational matters at another colleague’s company in London. After year and a half I returned to Poland to sort out family matters and found a job as an auditor in the hotel industry. It was a difficult job, because it involved pointing out mistakes, while my nature is to praise people. Thus, after three years, I quit it

What made you go into insurance?

I came across an ad offering cooperation with Aviva (now Allianz). I went there unconvinced, thinking it wasn’t for me. However, I was invited to a training session with a man who showed me what insurance was for in terms of succession in a family, a company. It was only then that I saw the sense in it and gained momentum.

Is succession insurable?

Yes, and it’s best completed at the time of setting up the company. The idea is to secure its existence regardless of the circumstances that arise later. I advise on how to secure your TIN (taxpayer identification number), the company owners, the management staff and even the debt – after all, many entrepreneurs take out loans or credits. I pay attention to matters of securing assets, I go deep into various situations, e.g. when you enter into a partnership with several people: what happens if a partner is missing or if they’re ill for a long time – lastly, this generates enormous costs. When it comes to handing over the business, I analyse how to secure the successor so that they receive a decent annuity. Families rarely discuss succession issues, especially when having young children. It’s worth knowing that when a spouse is missing, because of their (tragic) death, the person who is left alive can do nothing. The bed will not be sold, the house will not be rented without the permission of the family court. All this can be settled and secured much earlier. Very few people create the bank security for posthumous payments. Today you have access to the account, but when your husband is gone you no longer do, unless it is joint, but then you are only entitled to half the funds.

You have acquired MaxiDISC certified consultant and consultant certificates. How many insurance trainings does it take?

It’s hard to count. I’ve been training all the time. I work with Allianz as an agent and it’s important to know the product I’m selling well. It’s not just about the general insurance terms and conditions, but about the security itself, the product created and tailored to the customer, the whole system of financial and legal security. I work with a staff of people: lawyers, accountants. The policy isn’t a coincidence, it has to be very well tailored. I don’t like someone saying: I’ll close your policy and open a new one. You must sit down and analyse what you need today, then look through the current policy and finally insure what is missing, depending on expectations. I always ask: under what circumstances should the policy work?

You insure both individuals and companies. When did you set up the GROWTH LD?

In 2012. I employ one person permanently to run the office affairs, and cooperate with others, e.g. IT specialists, graphic designers. In addition to insurance activity, since 2018 I have been running personal development courses devoted to leadership skills, organising Mastermind workshops, and I’ve been coaching. Sometimes we think the competencies an entrepreneur needs are knowledge of products or goods they’re selling. Meanwhile, many people confirm that their businesses started to prosper when they started to develop themselves internally. Understanding yourself, who you are, what direction you’re going in, or what you’re looking for, is the key. My business has also gained momentum since I recognised my dreams. I owe this to John Maxwell’s outstanding leadership group. I have become an even better agent, I can listen, and coaching really is a helping hand in insurances.

How did you acquire your coaching competencies?

Because I am part of the MLCT organisation, I have constant access to the platform where trainings are provided. I now provide group and individual training. I really love Masterminds. These are groups of 10 participants, we highlight the main theme, I start with mentoring and then we talk, we look at the issue from many sides and perspectives. This way we are able to see it through many different eyes and find a solution.

It requires lots of your time.

Yes, but then clients feel the bond with me. Now, I insure approximately 2,000 customers. In the very beginning, I went to all sorts of entrepreneurial meetings to get them, and now what works is referrals. They include medicine doctors, nurses, singers, railwaymen, military men, policemen… they call, they ask, and I constantly guide them. I even advise on health issues.

What kind of health coverage do you offer for middle-aged people?

Luxmed services, AOZ (Allianz Healthcare). It all depends on specialists needed, the scope of examination, and the expected reimbursement. It’s all individual. I always send out packages, but start from analysing cost incurred for private visits.

What are you most proud of?

I’m proud of the level I have already achieved in insurance, of being a member of the MDRT (the top 1% of life insurance advisers in the world), and also of noticing what’s really important in life: dreams and family. If someone asked me today who’s the most important to me, I would say with my eyes wide open: me. My children already know. My mum had always said they were the most important, and today I do exactly the same. Of course, there are other people important to me. I have been with my second husband since 2010. We understand each other, we respect each other, we can sit next to each other completely silent and simultaneously so comfortable with it.

I think free time for passions and recreation is essential to purify ourselves. How do you spend your moments free from work?

My passion is classical music. Listening to it calms me down. I love adventure books, although recently the professional literature prevails. I also like running, but I do it occasionally

What are your plans?

I want to expand the development area and organise more trainings, comprising leadership skills, reach out to people, including business owners.

Dorota Kolano

Beata Sekuła