An interview with Łukasz Surma – head of Akademia Księgowości in Wrocław, nominated for the title of Leader by Vocation – on the importance of orderly accounting, effective tax consulting and efficient communication between clients and accounting offices.

You are a lawyer by education – so why accounting?

During my studies, I started working at a claims management company specialising in obtaining compensation from insurance companies. This adventure lasted several years.

Then, together with a business partner, we opened a law firm, providing comprehensive legal services. Over time, in response to the real needs of our clients, an accounting office was established – namely Akademia Księgowości. Many clients returned after legal consultations with information that their accountants didn’t understand the proposed schemes or tax hybrids.

As I increasingly found myself explaining to accountants how they should do bookkeeping for a given business structure, I decided to create a company offering comprehensive accounting, tax and legal services. This resulted in much easier implementation of any strategy today. Poland, although underrated, is a tax haven – many of our clients legally pay 5–7% tax, while in developed countries it exceeds 50%. Of course, this is no secret.

Unfortunately, more than half of accountants in Poland aren’t open to any business changes concerning their clients – whether in the form of transformation, setting up new companies or implementation of holding structures. There’s still a large group promoting sole proprietorship, which I consider the worst form of doing business in Poland – expensive, risky and lacking in optimisation opportunities. The same applies to civil law partnerships and registered partnerships. A limited liability company offers much greater benefits and security, especially in difficult situations, although, of course, you need to have bit of knowledge about it.

It’s also worth remembering that setting up a company is oftentimes not based on a single entity, but on a group of cooperating business entities.

When exactly was Akademia Księgowości founded?

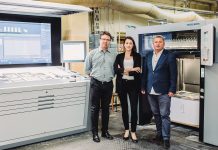

In 2017. While developing the company, I faced first serious challenge – the need to take a three-week leave of absence for family and business reasons. As the owner, I couldn’t afford to leave the company unattended. I quickly found a solution by inviting my father to join me. This is how a small family business was created. Today, we are among the top 5% of the largest accounting companies in Poland.

What services do you offer?

We specialise in tax optimisation. Our clients want comprehensive services within minimising tax burdens and social security contributions, as well as professional accounting plus legal and tax services.

I have many meetings with entrepreneurs and I know how important it is to have a well-organised business in terms of tax and legal matters, as well as precise and wise accounting, since many myths about companies went viral on the market, e.g. that taxes are higher than for sole proprietorships, that servicing companies is expensive, and that payment of funds is complicated. The reality, however, is completely different. We specialise in providing services to companies, primarily LLC, as well as to those in the Estonian CIT tax regime. To ensure high quality customer service, each company is assigned an accountant, an additional supervisor and access to the entire administrative department. This ensures fast and efficient communication. Arrangements regarding the company’s business model are immediately implemented within our office, which is very well received by entrepreneurs. The accountant receives clear information on how the accounting and tax services will be provided.

We serve companies from the moment they are established, but we also accept clients who want to change their existing accounting services, most often due to a lack of broadly understood consulting. Many entrepreneurs use low-cost accounting services provided by people without the appropriate qualifications, who have completed only one course without further education. Meanwhile, laws and regulations are constantly changing. Today, I can state with absolute certainty that half of the accountants in Poland do not have sufficient knowledge. As a result, entrepreneurs experience a mess in documentation, which may jeopardise the company’s existence. Some of them, due to numerous errors, have so-called unreliable commercial books, which means that the company is one foot in criminal and fiscal matters. We had a client who claimed that he lacked financial resources, even though his monthly profit was theoretically PLN 80,000. After taking over his accounting, it turned out that the actual profit was PLN 35,000. There are situations in which we, supported by the police, require the previous accountant to hand over documents, because she refuses to voluntarily do so, doesn’t open the door or is unavailable. Today, besides good accountants, entrepreneurs need also competent advisors.

Today, besides good accountants, entrepreneurs need also competent advisors.

Łukasz Surma

Do you organise training for your employees?

Yes, we’ve been constantly attending courses run by tax advisors – both stationary and online. We have access to specialist platforms where current regulations, interpretations and court rulings are published. We’re also supported by two tax offices. Our knowledge is constantly growing and is systematically updated. We thoroughly analyse each and every issue that may cause complications in our clients’ operations. Personally, I spend at least an hour every day on training to keep up with constantly changing regulations. Sometimes I act as a speaker at courses for entrepreneurs, sharing my knowledge on what to do to run a business safely. Today, the Revenue Service is equipped with advanced systems and algorithms that analyse the legitimacy of actions, transfer amounts and PIT data. Next year, all our cost invoices will be transparent. Even an already closed down company may be subject to a tax audit. So, by having our accounting in order, we automatically organise tax issues as well. We individually work with each client to determine the legal and tax structure that best suits their needs and their specific business nature.

Do you also train your clients?

Yes, because we use modern online systems such as Saldeo and CRM. They are used for electronic document circulation, which ensures order, transparency and significant time savings. The client is required to send documents via these systems, so they know exactly when and what has been sent. Invoice descriptions are particularly important, as they facilitate subsequent analysis and settlement. Each client receives access to our CRM system, which allows them to issue invoices, monitor the company’s financial situation and keep track of taxes and profits on a daily basis. TWO or THREE times a week, we send newsletters with instructions and news that help our clients use the systems efficiently and better understand accounting and tax issues. The point is that the documents don’t get lost.

How do you win your customers?

Mainly through recommendations. We serve both sole traders and companies employing up to 500 people, including large commercial, manufacturing and service companies, developers and international entities. Our strength lies in the diversity of our clients, which gives us a broad perspective, extensive experience and a flexible approach to each and every type of business.

What are you most proud of?

My team. I employ 30 people, mainly women, including chief accountants. They’re highly knowledgeable, educated in their fields, familiar with the systems. I’ve managed to build a team of accountants who help each other. I select people with a positive attitude, which makes the team work well. There are also funny situations – for example, after a few months of cooperation, customers call worried, claiming that ‘something is wrong’ because… they pay very low taxes – this is how proper optimization works. We have clients who earn PLN 5 million a year and pay PLN 1.5 million in tax. After jointly determining that they need about half a million zlotys a year for their private lives, we manage to optimise the structure so that the tax drops to PLN 100,000. What makes me happiest is when, after a few years of working together, clients say they’ve managed to pay off their loan, PRECISELY BECAUSE THEY PAY MUCH LOWER TAXES. That’s how we calculate: with real needs and financial security in mind.

What are your development plans?

This development is ongoing. The potential on the Polish market is enormous, because the official and systemic changes that are coming will mean that clients will need us, and therefore the company will grow.

How do you spend your free time?

I’ve always loved sports – I was captain of the handball team at school, and later played for the WKS club. Sport taught me perseverance: even after failure, it’s worth getting back up and trying again – it’s the same in business. When something isn’t working, you have to analyze it, improve it, and move on. In winter, we travel to the mountains with our 6-year-old daughter – she skis, while my wife and I snowboard. At home, we build LEGO sets together, recently those robotically advanced. I love activity, travelling and reading popular science books. After my daughter was born, I explored the subject of health and supplementation, so that my whole family is in good shape.

It’s my wife, an interior designer, who constantly invites me to the world of art. She makes our family sensitised to the surrounding beauty by interacting with nature and its substance. She’s full of ideas. I never know if and when I’ll find another item in the car, essential for her new project. Simultaneously, she’s very pragmatic. The way she balances creativity and pragmatism impresses me greatly.

Dorota Kolano

Mariusz Sosnowski